News

Windows 8 Tablet Interest Declines, Study Says

A new report from Forrester shows a big drop in consumers interested in a Windows slate. But other studies have shown the opposite.

Microsoft has its work cut out for it in the tablet market, a new study finds.

As it prepares its tablet-focused operating system, Windows 8, for production, the competition continues to forge ahead with devices that have been out for some time.

Those conclusions can be found in a Forrester Research report that finds consumer interest in Windows-based tablets has declined over the past six months.

The report, based on a survey fielded in September of 2,300 consumers who claim they are not opposed to buying a tablet, shows a precipitous decline among those interested in tablets based on Windows.

The Forrester findings conflict with a report released last month (PDF) by Boston Consulting Group (BCG), which found 42 percent of existing tablet users wanted a Windows-based tablet while 53 percent of non-tablet users wanted one with Windows. However, the BCG survey was fielded earlier this year, in late spring.

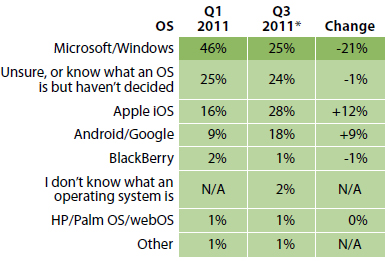

Back in the first quarter of this year, when Forrester asked what operating system users wanted on their tablet, 46 percent of those surveyed said they were interested in a Windows tablet. However, that figure dropped to only 25 percent in the third quarter. By comparison, those interested in Apple iPads rose from 16 percent to 28 percent. Interest also rose in Google Android-based tablets, from 9 percent to 18 percent.

Moreover, when asked by Forrester which brands they were considering, a sample of 1,800 respondents showed that 61 percent were interested in an iPad while only 10 percent wanted a Windows 8-based tablet, presuming it was available.

|

Breakdown of survey respondents' answers to the question: "Which operating system would you most prefer on a tablet?" (Source: Forrester)

Base: 3,835 US online consumers who are not opposed to buying a tablet

*Base: 2,299 US online consumers who are not opposed to buying a tablet

|

A Microsoft spokeswoman said the company is not commenting on the Forrester report.

Fueling the decline in interest in Windows 8-based tablets -- Microsoft's answer to the iPad and other more popular tablets -- is the fact that Microsoft's new OS won't be available for perhaps another year or more. A report by DigiTimes released Tuesday indicated that Windows 8 devices based on the low-power ARM architecture may not enter the competitive stakes until June 2013. Versions of Windows 8 are also under development for the Intel architecture. Microsoft has not stated a target delivery date for Windows 8.

"They [Microsoft] have missed the peak demand period in the minds of consumer buyers for a product that they simply haven't released yet," said Forrester analyst J.P. Gownder in an interview. The report described Microsoft as a "fifth mover" rather than a "fast follower" in the tablet market behind such devices as the iPad, Samsung Galaxy (based on Android), Research In Motion's PlayBook and the now-defunct WebOS-based TouchPad from Hewlett-Packard Co.

Does that mean Windows 8 is DOA when it arrives? Not necessarily, Gownder said. "A lot of it depends on the decisions that they make from here on out," he said. "I think Windows 8 still has a reasonable shot to be successful, but we have to see how they determine things like pricing. If Microsoft comes out and prices it the same as the iPad and it doesn't do anything that the iPad can already do, that's going to be problematic."

Adding to that challenge, he noted, are Amazon's Kindle Fire tablet, released in September, and Barnes & Noble's Nook tablet, released earlier this month. The two products are priced at $199 and $249, respectively. While not as robust as other tablets, these bare-bones devices have Web browsers and allow access to a broad array of content.

In a year from now, improvements in these devices and iPads, along with downward pricing pressure, mean Microsoft will be challenged to find a way to bring entry-level devices into the market starting at under $300, Gownder predicted. "I think the bar is high for them to figure out how to do this," he said.

With the so-called consumerization of IT, many users are simply bringing their devices of choice to their offices and using them instead of PCs for many tasks such as Web browsing, taking notes and viewing documents. With tools such as Citrix Receiver available for devices like the iPad, many users have access to enterprise apps, as well, the report noted. As a result, consumer appeal has more implications on what enterprises adopt than ever before.

Microsoft's key challenge will be to make Windows 8 an attractive platform for productivity and gaming -- something Apple has already succeeded in doing with the iPad, which now has 40 million users, Gownder said. The study found that one-third of tablet users create new documents on their devices, 36 percent edit them, and 56 percent view files, spreadsheets and presentations. Sixty percent use their tablets to take notes, while 21 percent conduct Web or video conferences on them.

Though there is currently no version of Microsoft Office for the iPad, users are content with the built-in Office-compatible iWork package or Quickoffice as an alternative, Gownder noted. "We are very struck that productivity and gaming scenarios, which are two [areas] that Windows should be best at, the iPad is doing quite a bit to satisfy user demand. Microsoft needs to figure those things out."

One area where Microsoft may be able to bring its IP to the table is with its Kinect gesture-based technology, now offered with Xbox and using voice recognition, Gownder suggested. Additionally, Microsoft should integrate Windows 8 with Xbox as it has with Windows Phone 7, which will appeal to many customers, he added.

Also to Microsoft's advantage is the fact that OEMs appear to remain committed to Windows 8, notably Dell and HP. Both companies have openly announced and emphasized their plans to develop systems based on Windows 8, the report noted. In addition, Forrester anticipates broad support from Acer, Asus, Lenovo, Sony and Toshiba.

About the Author

Jeffrey Schwartz is editor of Redmond magazine and also covers cloud computing for Virtualization Review's Cloud Report. In addition, he writes the Channeling the Cloud column for Redmond Channel Partner. Follow him on Twitter @JeffreySchwartz.